In part one of our new series, we look at how remote work is impacting municipal revenue (and how this can be addressed) in Cleveland and Cuyahoga County

By the Editors

Before COVID-19 ever hit our nation’s shores two years ago, the increased availability of online and electronic communications was making it easier for some employees to work at home, often removed from their employer’s place of business, and often in our state’s major metropolitan centers. Today, these major metropolitan centers are experiencing serious shortfalls in tax revenue due to remote working.

It’s a situation that cannot be easily resolved but has to be addressed. And the issue can be complex even for professionals. The Ohio Society of CPAs has issued a 25-page report entitled “Municipal Income Tax Withholding & Refund Q & A Guide.”

With the lifting of pandemic restrictions, it is apparent that workplace conditions have forever changed; there will be many employees who will prefer to work remotely. And employers are all too willing, and even encouraging, the expansion of remote working and flextime arrangements for their employees.

The Ohio General Assembly recognized the problem early on, and enacted legislation to remain effective only during the pandemic emergency declared by our governor. This legislation authorized municipalities to continue to collect income taxes at their employers’ places of business from employees who had been and were working remotely in 2020.

While the General Assembly dropped the provision from the recently enacted bill for refunds provided for taxes withheld in 2020, the issue of constitutionality of the prior provision authorizing municipalities to tax workers during the continuation of the pandemic is still to be determined by current legislation. The budget bill now specifically authorizes refunds for taxes by remote workers during 2021.

However, the constitutionality of that legislation is being challenged in litigation brought against Cleveland, Columbus, Cincinnati and Toledo. The Ohio Senate, in its version of the biennial budget bill, is reported to be providing refunds for remote-working employees in the amount of income tax that has been withheld from their pay during the pandemic.

Whether by litigation or legislation, our state’s major municipal centers, which are centers of employment of nonresidents, will be faced with millions of dollars of liability for income tax refunds.

So what can be done?

In the first of a three part series, Ohio Business will address the issues surrounding remote work and municipal taxes in Cleveland, Columbus and Cincinnati, asking tax and human resources professionals in those communities for their insights for possible solutions.

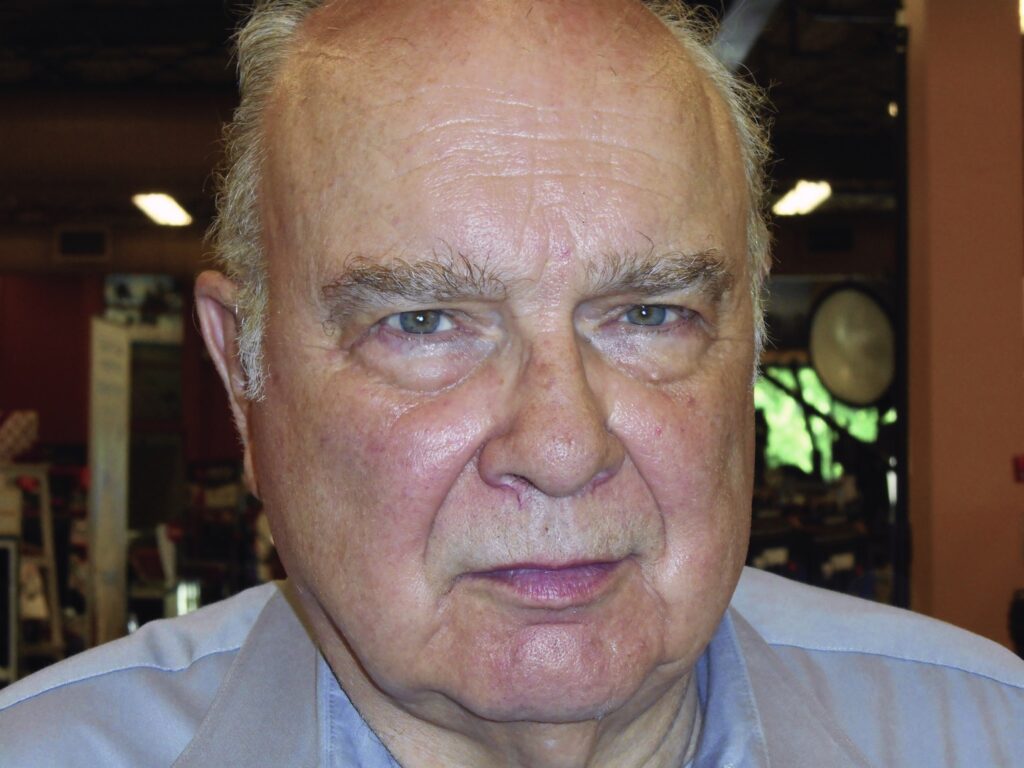

Our immediate thanks is to Eugene L. Kramer, attorney at law, of Lakewood and Cleveland, for bringing this very important issue to our attention. The author of the current Cuyahoga County Charter and instrumental in writing and passage of the Summit County Charter approved by voters in 1979, Attorney Eugene Kramer has been practicing law for more than 57 years.

In addition to his focus on government and public policy, Kramer’s extensive practice has included representation of and advice to numerous local, regional and state governments and agencies and service as a municipal law director, as well as drafting of much of the state legislation providing for the levying of local optional taxes such as the county and regional transit authority sales and use taxes.

From Attorney Kramer:

“Now that cities are going to have to begin paying refunds and experiencing the loss of current revenue because of remote working, they are going to have to look to a solution for the enormous loss of income they will be experiencing.

“I have presented to quite a few people the solution of a countywide income tax that I told you about a while ago and have yet to hear from anyone why this solution will not work or any alternative solution. This problem will not go away when and if the pandemic ends or abates, since many people have come to enjoy and prefer and to experience financial benefits from working remotely.

“As soon as more people begin to realize that any day spent working in Cleveland or other nonresident city costs them money, they will have an incentive to want to work from home even if that conflicts with the employer’s needs or desires, thus setting up potential employment relations problems.

“Because Cuyahoga County has a charter form of government and its territory consists almost entirely of cities and villages, my proposed solution might currently be workable there. The only solution for the rest of the state that I can think of might be for the General Assembly to create some kind of ‘piggyback’ tax on top of the state income tax or to increase the state income tax in an amount sufficient to make up the lost revenue to the individual municipalities, which is probably not a likely outcome.

“Cleveland especially and the other employment centers in the county cannot withstand the loss of revenue and their ability to provide for necessary public services. The last thing Cleveland needs is a continuing deterrent to people coming into the city to work and to spend money.

“A countywide income tax could help to limit that effect. Under Article 10, Sections 3 and 4, of the Ohio Constitution, the voters of Cuyahoga County could amend the Cuyahoga County Charter to provide for the county to have exclusive authority to levy and collect an income tax in the county, which would replace all of the existing municipal income taxes in the county. The tax would be levied on the same incomes of businesses and individuals that now are taxed by the municipalities in the county. The county would not retain any of the revenue from the tax and would contract with an agency such as CCA or RITA to administer and collect the tax.”

When could the proposed county charter amendment be submitted to the voters?

“County charter amendments may be submitted only at November general elections, so the earliest opportunity would be on November 8, 2022.”

What vote would be required for adoption of the proposed charter amendment?

“In this case, because the proposed charter amendment would involve giving exclusive municipal powers to the county, three separate majority affirmative votes would be required: (1) in the county at large, (2) in the city of Cleveland and (3) in the county outside the city of Cleveland.”

How would the countywide tax affect individuals?

“All income subject to municipal income taxation earned in the county would be taxed regardless of the residence of the taxpayer. Only a single tax return would have to be filed annually by persons who live and work in the county. The tax would be withheld from payrolls as in the current system. In the case of a county resident who earns income outside the county, a partial credit would be provided for income tax paid to a municipality outside the county.”

How would the countywide tax affect businesses?

“Business, regardless of the number of locations they operate in the county, would file a single tax return and pay a single tax amount. Business would continue to be required to withhold the income tax from payrolls.”

What would be the rate of the tax?

“The rate of the tax would be calculated as the amount estimated to be necessary to approximate the aggregate amount of municipal income tax proceeds realized by the combination of all of the municipalities in the county in 2019—the last full year before the onset of the pandemic.”

Could the county increase the rate of the countywide tax?

“The rate of the tax could be increased only with a vote of the people of the county. Under the current system, taxpayers cannot vote on the rate of the tax in the municipality where they work but do not live.”

How would the tax proceeds be distributed?

“Each municipality would receive a portion of the tax proceeds equal to the proportion of the total municipal tax proceeds collected in the county in 2019 that the municipality received in that year. That distribution formula could be altered only with the concurrence of a specified percentage (say, two-thirds) of the municipalities in the county.”

What other avenue is available for municipalities in the county to make up for revenue lost because of remote-working?

“A municipality could ask its residents to vote to increase the rate of the municipality’s existing tax rate in amount estimated to make up the difference.”

Wouldn’t it be unusual for a county to be able to levy an income tax?

“No Ohio county currently levies an income tax, but Cuyahoga County levies and collects countywide property, sales and use, motor vehicle license, real property transfer, and hotel taxes.”

What other effects would result from adoption of the plan?

“Continuation of the current situation will provide a significant financial incentive for nonresident employees who are able to do so to work remotely, regardless of their employer’s needs or wishes. Reduced working population in the employment centers negatively affects restaurants and other businesses that serve those employees.

“A single, countywide income tax would eliminate anticipated income tax revenues from job-producing developments as an incentive for municipalities in the county from engaging in competition for the location of such developments and the need for income-tax-sharing agreements in connection with the location or relocation of developments.”