Under the governor’s orders, companies statewide have started to reopen their facilities

by Terry Troy

With many states initiating phased-in restarts of their economies this week, public health officials have voiced concern over whether or not the restarts are coming too soon. However, the novel coronavirus has wreaked havoc on our state’s economy. According to the Ohio Department of Job and Family Services (ODJFS), 92,920 people filed new unemployment claims for the week ending April 25. That’s a significant drop from the 109,369 people filing claims the week prior, but is still way too high according to both government officials and economists. In order to revive Ohio’s economy, we have to stem the increases in unemployment and start adding back viable jobs. According to the ODJFS, in the state of Ohio 1,075,486 people have filed for unemployment over the last six weeks. There are more than 30 million people unemployed nationwide.

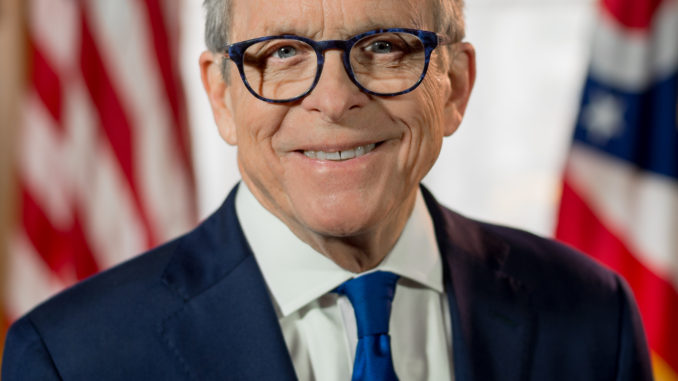

Governor DeWine’s phased-in approach started on Friday with the opening up of medical facilities for procedures that don’t require an overnight hospital stay as well as dentist and veterinarian offices. Monday, manufacturing, distribution and construction companies were allowed to reopen as long as certain guidelines are maintained. General offices were also allowed to reopen, with the provision that those who can work from home should do so. Indeed, Governor DeWine’s statewide stay-at-home order will remain in place until the end of this month. Next week, on May 12, consumer, retail and other services can open their doors, if they agree to operate under outlined community health protocols from the state.

There’s more good news for small businesses across the entire country. While the first round of the Paycheck Protection Program ran out of money quickly, the second round offering more than $310 billion, appears to be much more successful at getting loans into the hands of small businesses.

On Sunday, U.S. Small Business Administration Administrator Jovita Carranza and U.S. Secretary of the Treasury Steven T. Mnuchin today issued the following statement on the success of the second round of PPP:

“Since Round 2 of PPP loan processing began on April 27, 2.2 million loans have been made to small businesses, which surpasses the number of all loans made in PPP Round 1. The total value of these 2.2 million loans is over $175 billion. Notably, the average loan size in Round 2 is $79,000, yet another indicator that the program is broadly based and assisting the smallest of small businesses.

“Nearly 500,000 of the loans were made by lenders with less than $1 billion in assets and non-banks. These lenders include Community Development Financial Institutions, Certified Development Companies, Microlenders, Farm Credit lending institutions, and FinTechs. Over

850,000 loans—about one third of the 2.2 million loans—were made by lenders with $10 billion of assets or less.

“Since the launch of PPP on April 3, SBA has processed over 3.8 million loans for more than half a trillion dollars of economic support in less than one month.”

However, there are still some glitches in the system, as small business owners across our state will attest. And there are still some organizations that are applying for PPP that don’t necessarily need the funds, although these are being weeded out quickly by the lending institutions and government entities.