State has manufacturing resources to lead for decades

By Terry Troy

According to a new report, Ohio is uniquely positioned to become an industry leader and hub for advanced technologies that can reduce emissions and innovate the entire automotive industry, perhaps for decades to come. The report entitled “Ohio Battery Supply Chain Opportunities,” was co-sponsored by JobsOhio and NRDC (Natural Resources Defense Council) and authored by the consulting firm of Benchmark Mineral Intelligence (BMI).

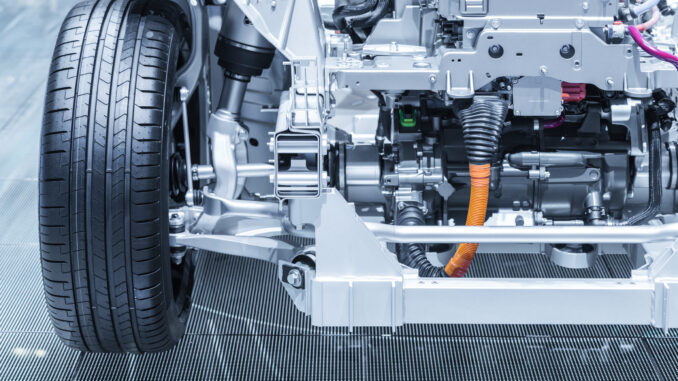

The report cites recent initiatives made within our state aimed at building an auto supply chain that capitalizes on lithium-ion battery manufacturing, such as the GM/LG (Ultium Cells) Chem Lordstown investment and other facets of EV development.

“As the industry continues to innovate and steer itself towards a future focused on a growing EV supply chain, this report solidifies Ohio’s value proposition as a premier destination for future innovation,” said J.P. Nauseef, president and CEO of JobsOhio. “JobsOhio was created to help bolster business and investment in Ohio, and our state is prepared to seize future opportunities in the industry that can bring good-paying jobs for Ohio’s workforce while reducing emissions in our state.”

The report notes that the state has made a multi-decade commitment to the automotive supply chain, resulting in more than 90 percent of Ohio’s exports currently related directly or indirectly to the automotive industry. That well-developed infrastructure and logistics landscape puts the state in prime position to serve growing consumer interest in electric vehicles (EV).

According to the report, Ohio has the second-largest automotive workforce in the country and is ranked as a top state for solar development in the Midwest over the next five years – key advantages for the state, making it a logical place for future investments in the EV supply chain as the auto industry is increasingly wanting renewable energy sooner and closer to their operations.

According to the report’s analysis, Ohio has important key advantages. The first is the state’s ability to quickly take a leadership position among U.S. states for implementing both upstream and downstream policies. Ohio is also a premier location for a cathode active materials (CAM) investment given the state’s already significant EV investments, which include the $2.3B investment in the GM/LG Chem (Ultium Cells) Lordstown plant, that will lead to further industry growth and job creation.

Ohio has well-developed infrastructure and logistics that have been pivotal to the state’s strong multi-decade commitment to the automotive supply chain. There is large and growing solar energy industry in Ohio. Increasing renewable energy penetration can guarantee lower energy costs.

“Ohio has a unique position in the domestic supply chain for electric vehicles. With a quickly growing solar industry and a well-established automotive supply chain legacy, Ohio has an opportunity to lead the U.S. domestic EV supply chain build-out,” said Andy Leyland, Head of Supply Chain Strategy, Benchmark Mineral Intelligence. “Ohio is a premier location for CAM manufacturing. A successful effort will create a positive feedback loop that will help to attract other aspects of this supply chain, including anode manufacturing, chemical processing, and even recycling. Ohio should seek to align its policy with this investment attraction effort to protect and build on its automotive heritage as the industry pivots to electric transportation solutions.”

“This report makes clear that Ohio can pursue emissions reductions while creating good jobs and attracting new investment. In fact, it shows that the two go hand-in-hand as the auto sector aims to sell its customers a carbon-free electric vehicle,” said Dan Sawmiller, Ohio Energy Policy Director for NRDC (Natural Resources Defense Council). “JobsOhio is playing an important role in bringing new jobs and investment to Ohio while reducing emissions in the state. They understand the value that Ohio’s growing solar energy economy can have in attracting new investment.”