To access information about accounts and pay premiums, the Ohio Bureau of Workers’ Compensation is encouraging employers and employees to create e-accounts. E-accounts began in October 2000, allowing employers to do business with the bureau and injured workers to track claim information and benefits.

The BWC provides instructions for creating an account.

Creating an Employer E-account

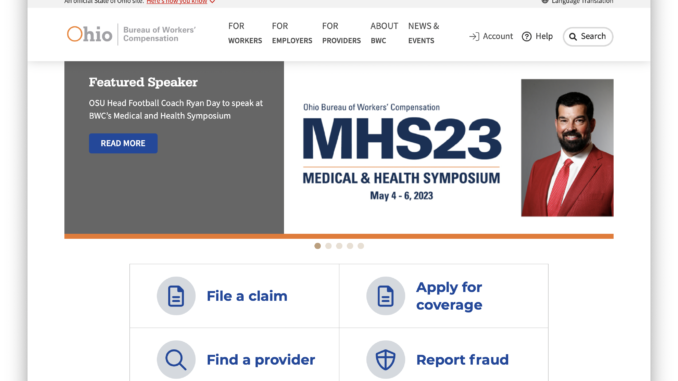

- Click My Account in the upper, right-hand corner, and then click Create an account.

- Enter your first name, last name, email address, department and title (required), and then click Next.

- Select “I am the employer, or I work for an employer,” and then click Next.

- Enter the policy number (without leading zeros and business number; 0005555–0 would be entered as 5555.), Federal Tax ID or Social Security number, business location ZIP code and business email address. Click Next.

- Continue to follow the online instructions for setting up your e-account.

Creating a Worker E-account

- Click My Account in the upper, right-hand corner, and then click Create an account.

- Enter your first name, last name and email address, and then click Next.

- Select “I am the injured worker,” (or select the option that applies to you) and then click Next.

- Enter your BWC claim number (as shown on the BWC ID card you received in the mail), date of the work-related injury (as shown on the BWC ID card), Social Security number and date of birth. Click Next.

- Continue to follow the instructions for setting up your e-account.

Multiple individuals can have access to policy information in an e-account, so if several people handle workers’ compensation issues, one primary e-account can be created, with other individuals added as secondary users. All secondary users must have their own user IDs and passwords.

Online, employers can manage their policies, pay bills and complete their payrolls true-up. Premiums are calculated through the true-up process, which requires employers to report their actual payroll for the previous policy year and reconcile any differences in premium paid.

If there is no reconciliation to be made—meaning that their payroll for the year matches what the BWC estimated—employers still must submit true-up reports.